Market cap - Total value of a company in stocks

Small-Cap companies - about $300 million to $2 billion - Higher risk but even higher potential to grow.

Mid-Cap companies - between $2 and $10 billion - Less volatility, still not mature enough companies but still Higher chance to grow.

Large-Cap companies - $10 billion or more - mature companies with certain history, the risk is lower and they are good for conservative investors who want to keep their capital in safer assets. Many of them are between dividend aristocrats or kings.

Debt to assets ratio

This ratio measures the amount of leverage used by a company in terms of total debt to total assets. If the ratio is more than 100%, it means the company has more debt than assets and it is not good invetment in my opinion. The best choice is 0%. I chose usually companies with debt to assets ratio not higher than 60%. The debt to assets ratio can be also negative and that means a company can be before a bankrupt and it is a very risky investment. But history showed us even that companies before bankrupt CAN be good investment. It is always needed to think about what we CAN get for the value we invest.

CEOs buy shares of their companies

It means the CEO trully believes in the company and its success and growth. It is very good sign for many investors to buy the shares too.

Dividend payout history

It is a good sign when a company has long dividend payout history and the best way is, when it does it quarterly or even monthly. Some of the companies are called aristocrats and it means they do dividend payout for more than 25 years with no break and the dividend increases in time. What is dividend? It is a kind of reward for investors/shareholders that company releases from its earnings. It can be in form of cash or shares.

History of the market chart

Would you buy a company which is losing its value constantly for more than 5years for long-term investment? I guess there is nothing more to say about this.

What are reinvestments and compound effect?

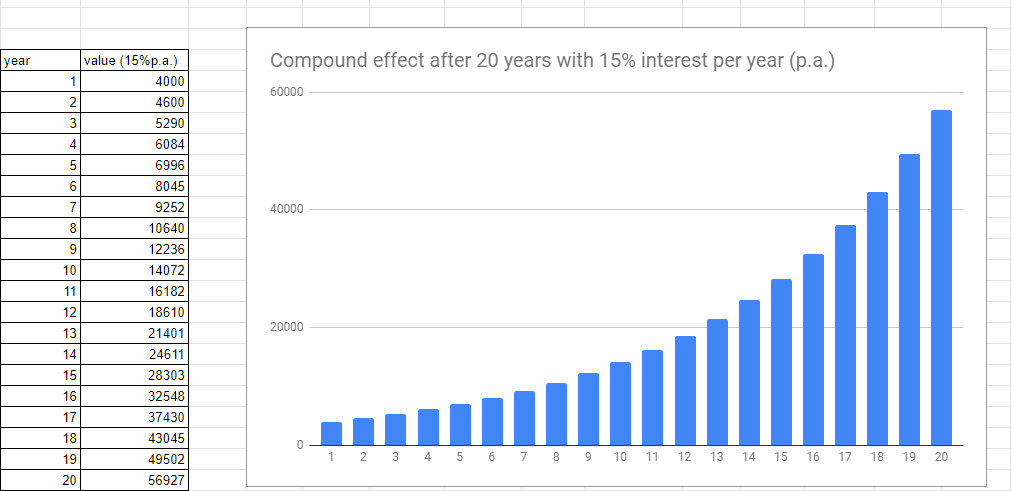

Reinvestment - It is a technique that we use to invest our dividends, interest or another kind of money that is generated by our investments to extend our investment portfolio and it literally means we have more without investing extra money from our own pocket. And the results of this technique is called COMPOUND EFFECT. The chart below shows us the power and result of compound effect after 20 years with 15% interest per year with only one time investment of 4000Eur.