Note: Dividends, P2P interest are reinvested. - What reinvestment is and what it brings is explained in the section of Stock Picking Criteria + Compound Effect.

Portfolio balance as of 31.8.2024

Overall value - Eur 2774.87

Overall Gain/(Loss) between 1.8.2024 to 31.8.2024 - Eur (-112.37); (-4.149%)

Stocks only Gain/(Loss) between 1.8.2024 to 31.8.2024 - Eur 0.91; 0.10%

Crypto only Gain/(Loss) between 1.8.2024 to 31.8.2024 - Eur (-61.32); (-17.72%)

P2P only Gain/(Loss) between 1.8.2024 to 31.8.2024 - Eur 8.85; 1.0801%

Art section - Gain/(Loss) between 1.8.2024 to 31.8.2024 - Eur (-64,57); (-12,6310%)

Income/Revenue from Dividends; P2P interest between 1.8.2024 to 31.8.2024 - Eur 12,68

Note: The value of the portfolio is much lower compare to the previous years because I don't have my personal emergency fund in case something happens. And the year of 2023 was financially pretty difficult as I was jobless for couple of months, so I sold practically all of the liquid assets. Also, I removed Glocin project from the portfolio for the time being as the company is in troubles for some time. However, from time to time they release some news, so we'll see where it goes. So, it's another reason why the portfolio value decreased.

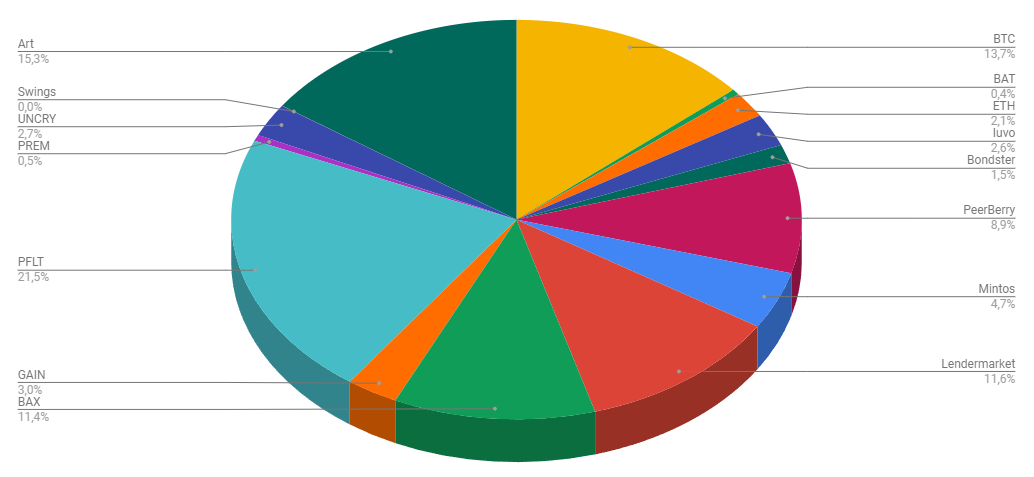

Portfolio balance as of 31.8.2022

Overall value - Eur 4949.97

Overall Gain/(Loss) from 1.8.2022 to 31.8.2022 - Eur 38.22; 0.7498%

Stocks only Gain/(Loss) from 1.8.2022 to 31.8.2022 - Eur 4; 0.1790%

Crypto only Gain/(Loss) from 1.8.2022 to 31.8.2022 - Eur (-13.98); (-13.0143%)

P2P only Gain/(Loss) from 1.8.2022 to 31.8.2022 - Eur 6.44; 0.646%

Art section - Gain/(Loss) from 1.8.2022 to 31.8.2022 - Eur (-24.26); (-13,1100%)

Income/Revenue from Dividend; P2P interest; and Glocin drawings (if the drawings are done) from 1.8.2022 to 31.8.2022 - Eur 83.04

Note: The lower value of the portfolio compare to the previous month is caused by non-expexted withdrawals.

Legend: Art - Physical objects as pictures, etc.; SSSS - SuRo Capital Corp. Common Stock; PFLT - PennantPark Floating Rate Capital Ltd. Common Stock; GAIN - Gladstone Investment Corporation Business Development Company; CAH - Cardinal Health, Inc. Common Stock; Mintos, PeerBerry, Iuvo, Bondster,Lendermarket & ViaInvest - P2P platforms; BTC - Bitcoin; BAT - Basic Attention Token; Glocin - Glocin platform; cash - just cash; Youtube - one time youtube channel investment

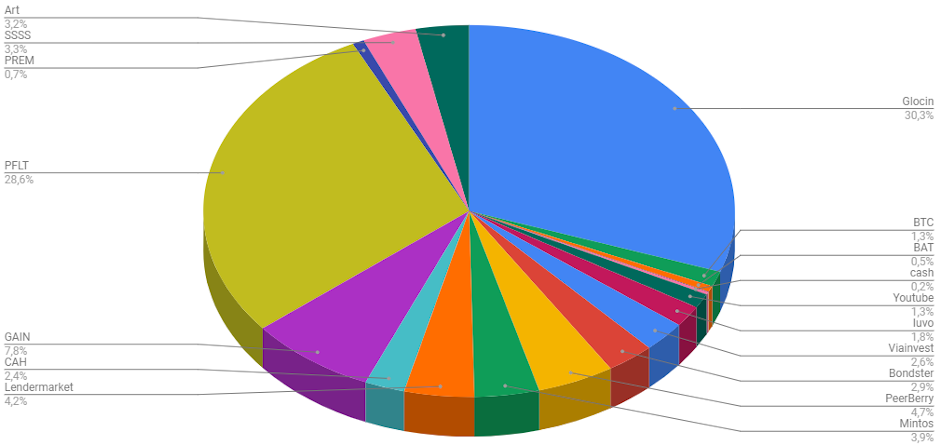

Portfolio balance as of 31.7.2022

Overall value - Eur5096.75

Overall Gain/(Loss) from 1.7.2022 to 31.7.2022 - Eur291.72; 6.0736%

Stocks only Gain/(Loss) from 1.7.2022 to 31.7.2022 - Eur257.62; 13.2201%

Crypto only Gain/(Loss) from 1.7.2022 to 31.7.2022 - Eur19.17; 25.4548%

P2P only Gain/(Loss) from 1.7.2022 to 31.7.2022 - Eur7.69; 0.725%

Art section - Gain/(Loss) from 1.7.2022 to 31.7.2022 - Eur39.26; 26.92918%

Income/Revenue from Dividend; P2P interest; and Glocin drawings (if the drawings are done) from 1.7.2022 to 31.7.2022 - Eur20.47

Note: P2P lending assets seem like the trend changes to positive results. Let's wait for another month to see what will happen.

Legend: Art - Physical objects as pictures, etc.; SSSS - SuRo Capital Corp. Common Stock; PFLT - PennantPark Floating Rate Capital Ltd. Common Stock; GAIN - Gladstone Investment Corporation Business Development Company; CAH - Cardinal Health, Inc. Common Stock; Mintos, PeerBerry, Iuvo, Bondster,Lendermarket & ViaInvest - P2P platforms; BTC - Bitcoin; BAT - Basic Attention Token; Glocin - Glocin platform; cash - just cash; Youtube - one time youtube channel investment

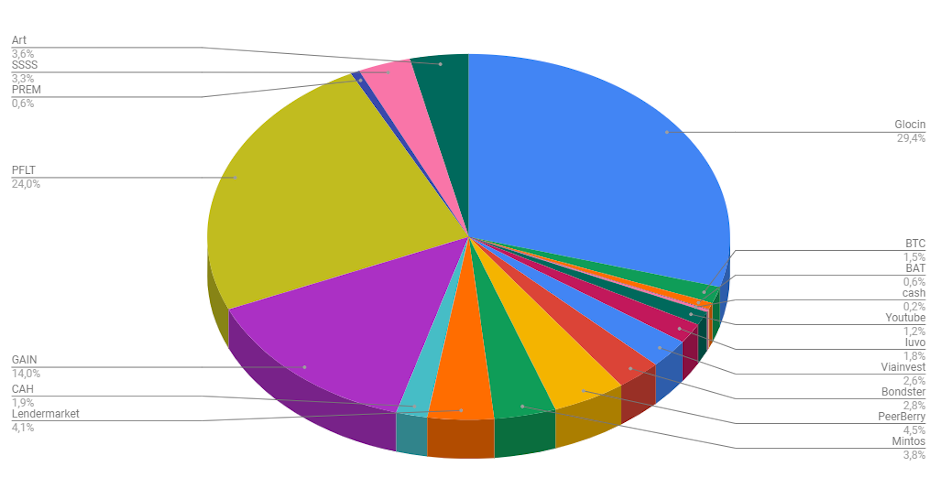

Portfolio balance as of 30.6.2022

Overall value - Eur4803.03

Overall Gain/(Loss) from 1.6.2022 to 30.6.2022 - (-Eur362.77; -7.0225%)

Stocks only Gain/(Loss) from 1.6.2022 to 30.6.2022 - (-Eur559.81; -23.0045%)

Crypto only Gain/(Loss) from 1.6.2022 to 30.6.2022 - (-Eur29.03; -27.8225%)

P2P only Gain/(Loss) from 1.6.2022 to 30.6.2022 - Eur5.23; 0.498%

Art section - Gain/(Loss) from 1.6.2022 to 30.6.2022 - (-Eur87.16; -37.4158%)

Income/Revenue from Dividend; P2P interest; and Glocin drawings (if the drawings are done) from 1.6.2022 to 30.6.2022 - Eur83.16

Note: It generally seems, all the world is passing something that we call recession. The huge decrease on stocks is caused not only by the falling markets but even by a failed trade. And this is the reason, why I'm the long-term hold investor. Because short experiments can cause extreme losses.

Legend: Art - Physical objects as pictures, etc.; SSSS - SuRo Capital Corp. Common Stock; PFLT - PennantPark Floating Rate Capital Ltd. Common Stock; GAIN - Gladstone Investment Corporation Business Development Company; CAH - Cardinal Health, Inc. Common Stock; Mintos, PeerBerry, Iuvo, Bondster,Lendermarket & ViaInvest - P2P platforms; BTC - Bitcoin; BAT - Basic Attention Token; Glocin - Glocin platform; cash - just cash; Youtube - one time youtube channel investment

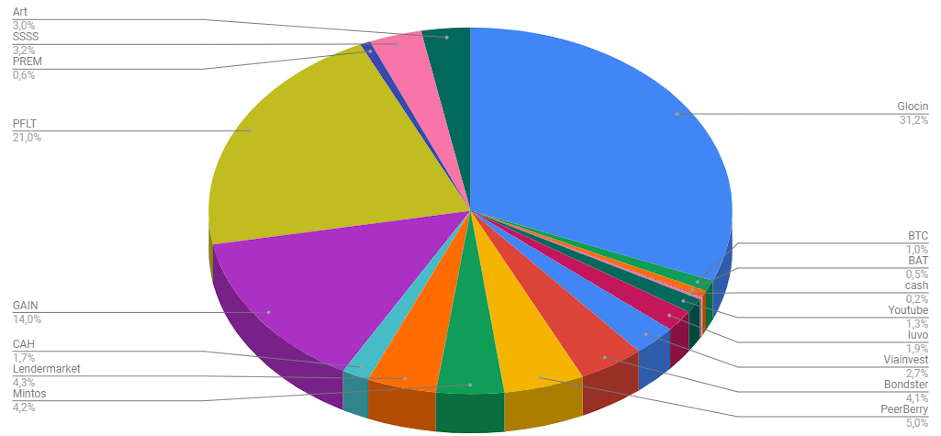

Portfolio balance as of 31.5.2022

Overall value - Eur5165,80

Overall Gain/(Loss) from 1.5.2022 to 31.5.2022 - (-Eur530.55; -10.1609%)

Stocks only Gain/(Loss) from 1.5.2022 to 31.5.2022 - Eur46.89; 2.1507%

Crypto only Gain/(Loss) from 1.5.2022 to 31.5.2022 - (-Eur351.66; -84.0267%)

P2P only Gain/(Loss) from 1.5.2022 to 31.5.2022 - Eur5.22; 0.497%

Art section - Gain/(Loss) from 1.5.2022 to 31.5.2022 - Eur14.95; 6.8587%

Income/Revenue from Dividend; P2P interest; and Glocin drawings (if the drawings are done) from 1.5.2022 to 31.5.2022 - Eur15.73

Note 2: The huge crypto fall includes a "crypto theft" from SafePal wallet, which is approximately 1/2 of it and it's lost forever. It was a calculated risk anyway. P2P lending are slowly "recovering" from the conflict in Ukraine, so I still consider them as no default.

Legend: Art - Physical objects as pictures, etc.; SSSS - SuRo Capital Corp. Common Stock; PFLT - PennantPark Floating Rate Capital Ltd. Common Stock; GAIN - Gladstone Investment Corporation Business Development Company; CAH - Cardinal Health, Inc. Common Stock; Mintos, PeerBerry, Iuvo, Bondster,Lendermarket & ViaInvest - P2P platforms; BTC - Bitcoin; BAT - Basic Attention Token; Glocin - Glocin platform; cash - just cash; Youtube - one time youtube channel investment

Portfolio balance as of 30.4.2022

Overall value - Eur5221.47

Overall Gain/(Loss) from 1.4.2022 to 30.4.2022 - (-Eur13.80; -0.2710%)

Stocks only Gain/(Loss) from 1.4.2022 to 30.4.2022 - Eur46.70; 2.3251%

Crypto only Gain/(Loss) from 1.4.2022 to 30.4.2022 - (-Eur68.45; -14.5899%)

P2P only Gain/(Loss) from 1.4.2022 to 30.4.2022 - Eur7.91; 0.760%

Income/Revenue from Dividend; P2P interest; and Glocin drawings (if the drawings are done) from 1.4.2022 to 30.4.2022 - Eur18.86

Legend: SSSS - SuRo Capital Corp. Common Stock; PFLT - PennantPark Floating Rate Capital Ltd. Common Stock; GAIN - Gladstone Investment Corporation Business Development Company; CAH - Cardinal Health, Inc. Common Stock; Mintos, PeerBerry, Iuvo, Bondster,Lendermarket & ViaInvest - P2P platforms; BTC - Bitcoin; BAT - Basic Attention Token; Glocin - Glocin platform; cash - just cash; Youtube - one time youtube channel investment; SafePal - Liquid mining platform

Diversification

So, what does it mean?

Our capital is like a sport team, army or a fruit garden. Would you plant one tree only or would you figth with an army with no back ups?

During certain moments, some of our assets can decrease their value. It can be temporary or a total lost. The question is - would you like to lose everything in one card? Answer yourself.

Imagine a situation when you lose a fruit tree. You will plant a new one. But what if the new tree would die too? You would have to plant another one. So would it not be better to plant more trees together to make sure at least some of them would survive and would they bring the fruits? And again, how to choose the trees and what kind of tree to choose before we start?

If you do not want to think about that, you can choose an investment in S&P 500 index which is one of the easiest ways of investing and long-term statistics say you probably won't lose investing in it, but always think about the risk too.

So how to build your own portfolio?

There are rules that you can apply on your investments.

The 1st rule is: Always invest money that you can afford to lose.

The 2nd rule is: Always invest money that you can afford to lose.

It is simple. Eighter you can buy a few kilos of ice-cream or you can invest the same amount and after buy more ice-cream or an ice-cream factory :)

The portfolio shall be like this (we are talking about long-term investing): max 10% of crypto, 70% of stocks, and the rest 20% you can divide between risky start-ups and for example P2P lending which is becoming more and more popular and even more regulated and safe. It will be probably dynamic, according to situations on markets.