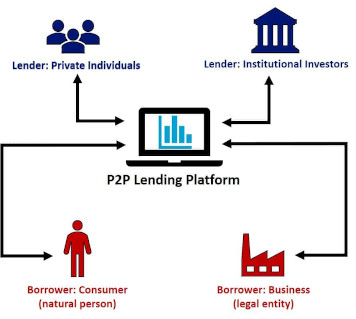

When investing via P2P platforms, you become practicaly a bank because the lending companies cooperate with the platforms. After providing a loan, the lending company will list the loan on a makretplace and you as investor can participate on a loan to receive interest. Exactly like a bank that provides loans to people or businesses. The below this text picture should help you to understand better.

My own criteria of chosing a P2P platform

History of the platform

This is a very important factor to me because I'm looking for stable opportunities that are 'tested' by time. So I prefer to chose platforms that are on the markets for longer time, but they must also bring results. Because some of the platforms that are here for many years lower their interests. We can call it a such trading style. Which means, when I use a platform and I see the performance is decreasing for certain time, I transfer the capital to another platform with higher interest. Yes, this is about money only and in this field mercy don't bring a lot of results. But it depends on our personality. Some of us can say, yeah ok, let it be, at least it helped someone to be happy. Generally, numbers MUST be in plus. And Yes, each cent matters. It is not only 20cents for example. Each cent matters.

The original country of the loans which are listed on the platform

I chose only European countries. Because of the economy. Yes it's true some of the loans from 3rd countries are providing higher interest but the ratio between Eur/Usd currencies and exotic currencies is many times like a rollercoaster and it literally means, the interest is not for example 18% but "only" 10% after exchange and the risk to invest somewhere where the currency and even a political situation is not stable is so high. Yes, it is about everything.

Buy back guarantee

High number of the loans listed on the platform is coming together with buy back guarantee. It means the loan originator guarantee to give you money back to protect you from default. What for example happens nowadays in Eastern Europe is really extraordinary case and let's be honest - guarantee in investments does not exist. However, my own experience with this kind of guarantee is good, because they do their own best, so I can't complain at all. Always make sure, you do diversification - what diversification is, is written in the section PORTFOLIO And No, diversification is not for idiots :)