© Divi Generator Formula

In this article, we will be passing thru a little mathematics. No, don't worry, it won't be rocket science.

So, we will work with a simple formula to compare two different companies which do monthly dividend payments. I like dividend companies, because they bring us free cash flow, so we can call them "money generator".

We won't talk about taxes and long-term price. The prices of the stocks change in time and even each place has different tax system, etc. So, these are the factors that influence our portfolios in reality. But now we are talking about theory which should be transformed to reality.

The formula will be called "Divi Generator Formula" or simply "DGF Pattern". We are seeking the highest possible number. But we should also think real.

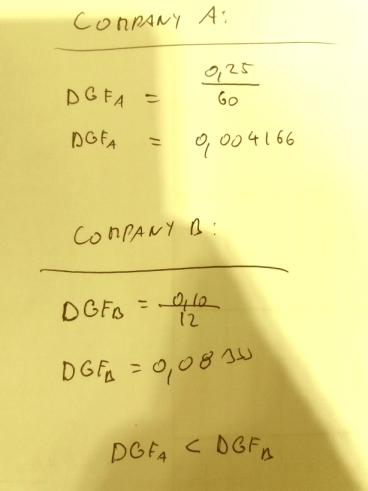

So, now the inputs. The 1st company will be called A and its current price is 60USD per share, its dividend will be 0,25USD per share. It will be a very well known company which is considered as high quality investment.

Our 2nd company will be called B. It will be a company which is stable, has got long history, including history of dividend payouts. It is just not that well known and popular. The share price will be 12USD and its dividend brings 0,10USD per share.

And now, the counting. It's simple and I believe easily to understand. (My former math teacher would kill me for placing the numbers like this :D )

The result is clear. The unknown but with long-term history company brings us better results than a well known company. Here, we can say, the cheaper is better. And I'm talking about the nominal value. What would I choose after this analysis? With no doubt - The company B.

©